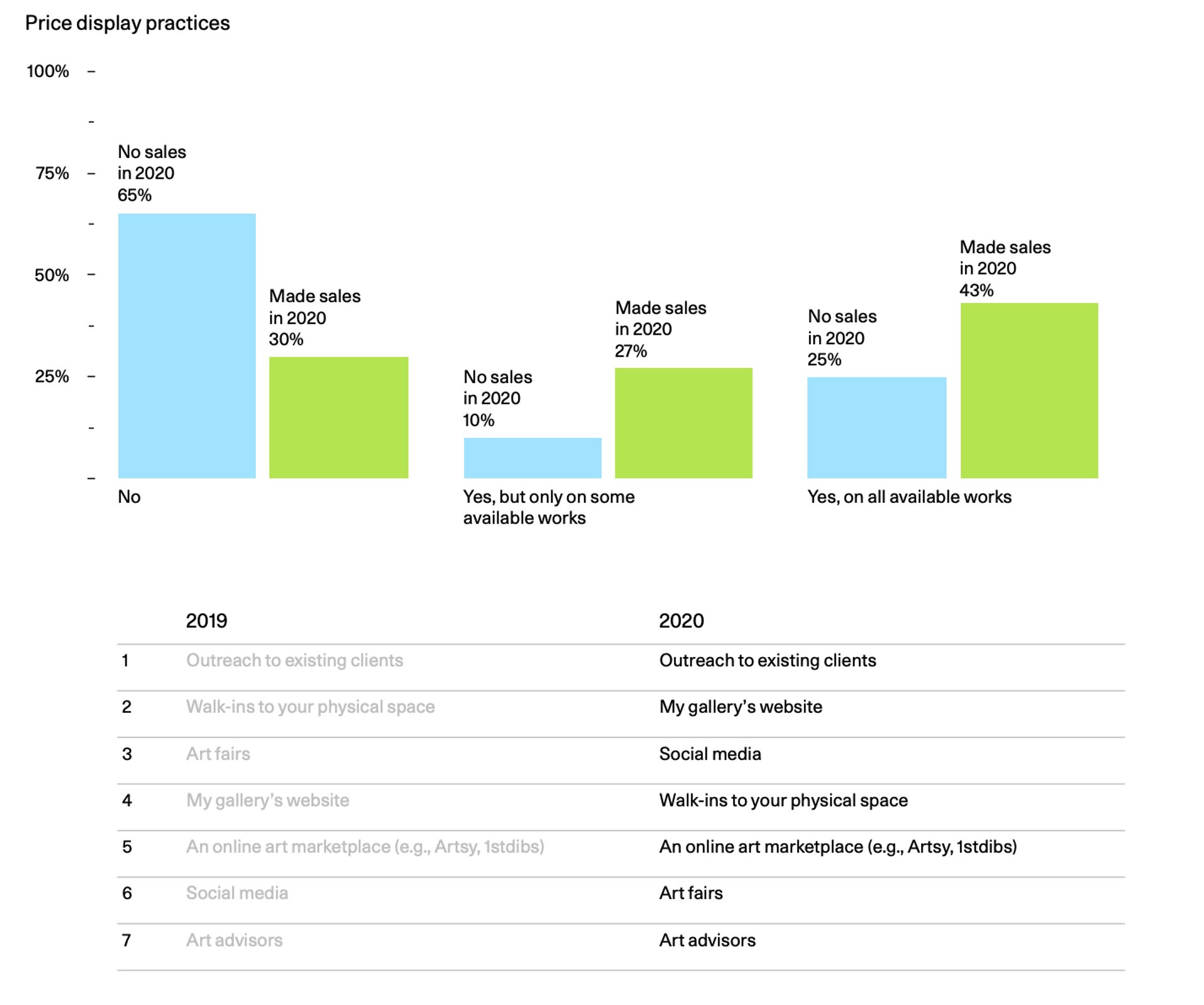

How the art world mighty have fallen. Art fairs—ranking as the third most successful way for galleries to sell art in 2019—has slipped to sixth position in 2020 because of the coronavirus pandemic, according to the Artsy Gallery Insights 2021 Report. Social media has replaced fairs, becoming galleries’ third best sales channel, moving up from sixth place in 2019. “The ranking of top sales channels shuffled considerably this year, with online sales, social media, and gallery websites taking the place of art fairs and walk-ins,” the report says. However, the number one way to sell art remains outreach to existing clients, accounting for 28% of total annual gallery sales in 2020.

Courtesy of Artsy

The Artsy Gallery Insights 2021 Report, which was conducted in October 2020 and surveyed 1,753 gallery professions, unsurprisingly shows a significant move towards the digital. “Galleries refined their digital strategies, invested in digital marketing, and tried new tactics to maintain bonds with existing clients and forge new connections online,” says Dustyn Kim, the chief revenue officer at Artsy, an online sales platform and database for art.

When looking at galleries’ use of social media in more detail, it possible to see a difference geographically. In Latin America and Africa and the Middle East social media is the second most successful platform for sales; in Europe it is the third most successful; and in North America and Asia and Oceania it doesn’t make the top three. Galleries say that they promote sales on social media using stories, direct messaging and organic posts.

Courtesy of Artsy

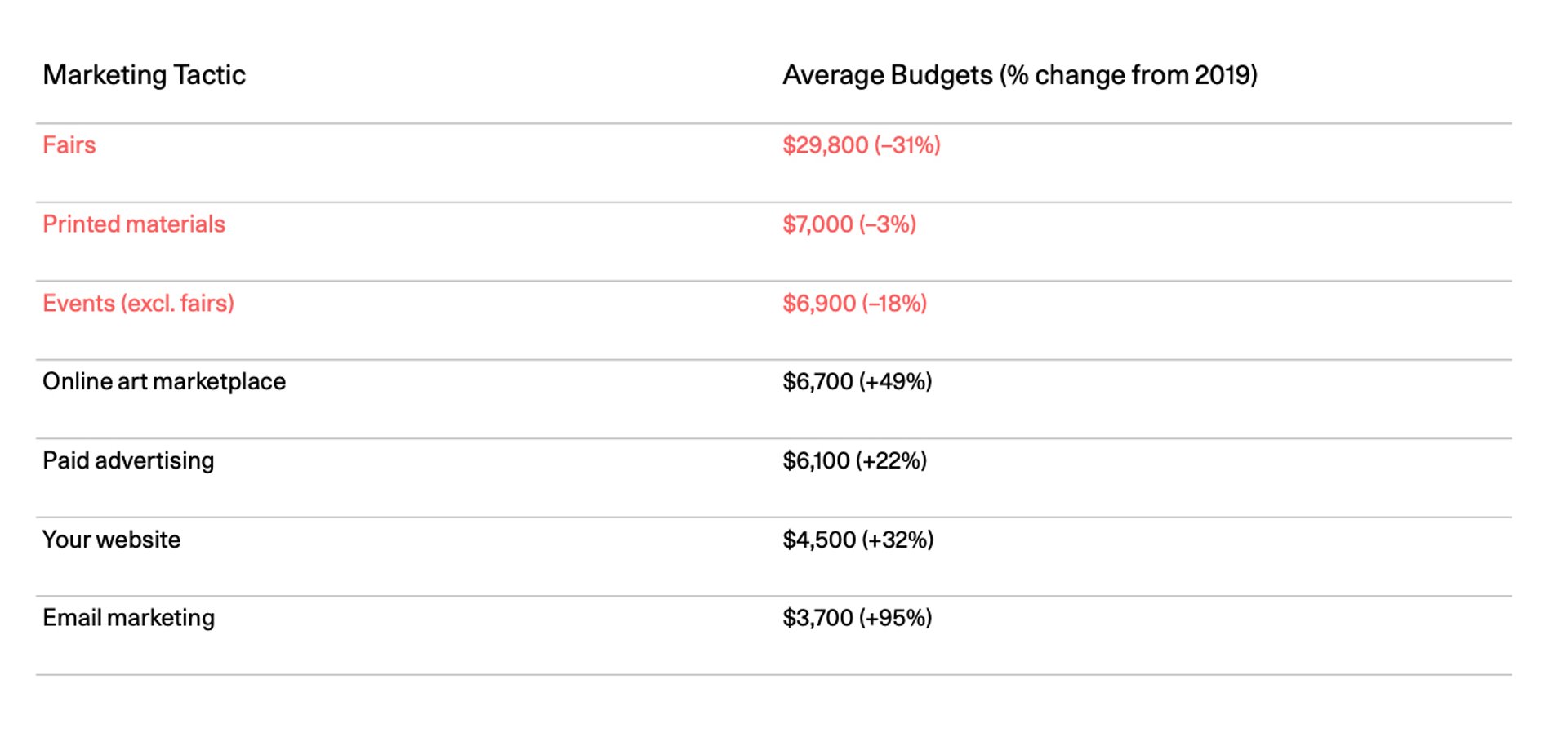

The study also reveals that galleries’ marketing budgets for online endeavours shot up: spending for online art marketplaces, websites and social media increased by 49%, 32% and 92% respectively. Meanwhile, there was a 31% decrease in budgets allocated for fairs. This shift to the digital is also changing galleries’ collector base; 73% of galleries reported that at least half of the collectors they connected with online in 2020 were new to their business and the number of buyers between 18 and 35 doubled, most likely because younger buyers prefer to buy online.

There was also a big jump in the number of galleries operating as an online-only business; 35% of the study’s respondents said that they had no physical gallery space, more than double the number reported in 2018 and 2019. “Financial concerns may […] provide incentive for an online-only model, as the world feels the economic strain of Covid-19,” the report says. “With an end to the pandemic in sight, 2021 will reveal whether these galleries return to brick and mortar or remain online permanently.”

But overall, the Artsy Gallery Insights 2021 Report expects that galleries’ new-found focus on the digital is here to stay: “It’s clear that the online art marketplace is not only a successful strategy to boost sales and stay connected this year—it’s also a trend that will continue into the future.”