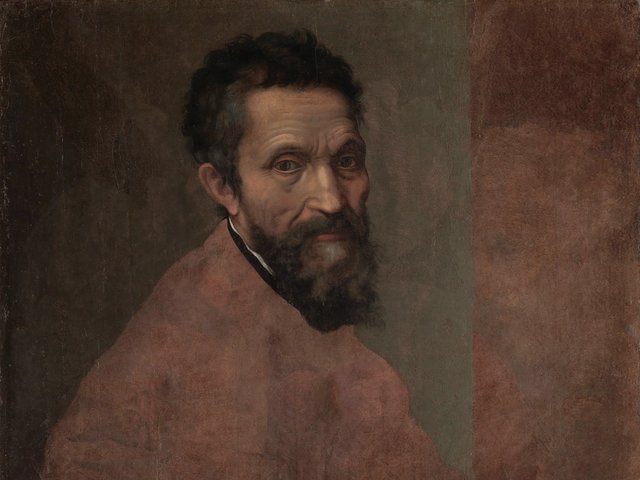

Many would argue that the construction business is more lucrative than investing in art. But in a bizarre example of the boom in fractional ownership of works of art, the new US owner of a Chinese building materials company has eschewed brickmaking in favour of art. It has bought a $75m Michelangelo painting by issuing shares and, earlier this month, suspended trading on the Nasdaq stock exchange until it has changed its name to Millennium Fine Art.

The unusual move comes under the company’s new executive chairman Daniel McKinney, who did not answer the question of why he has bought a Chinese construction business in order to start a US-based art investment business. The entrepreneur acquired a 91.2% stake in Yulong Eco-Materials (Yeco) after it completed the purchase of the so-called Millennium Sapphire for $50m on 17 October, which led to its share price soaring by over 600%. After selling Yeco’s construction business and all Chinese concerns, on 30 October McKinney moved the company to New York to concentrate on investing in works of art.

Earlier this month, the business announced it had bought a painting, described as a Michelangelo pietà, for $75m from a descendant of the Medici family by issuing 7.5 million $10 shares. McKinney says the painting was valued by Nica Gutman Rieppi of New York-based Art Analysis & Research, who also inspected Leonardo’s Salvator Mundi before its sale at Christie’s.

The day after the announcement of the Michelangelo acquisition in mid-December—which led to another surge in the company’s share price—the company was delisted from Nasdaq. However, McKinney says: “We are suspending trading on Nasdaq until our filings are up to date—not delisted.” He says the company will resume trading on Nasdaq under the new name of Millennium Fine Art. Of the Michelangelo purchase, he says: “We have now a proven concept that our business model can create a new alternative asset class in fine art via the securitisation of our shares.” While most fractional ownership schemes concentrate on contemporary art, that holds little interest for McKinney. He says: “We are only interested in Old Masters and Impressionists—no interest in contemporary art.”

The business is seeking to purchase more works and, according to a statement released in December, its “experts are traveling the globe over the next week inspecting several other masterpieces for possible acquisition, including works by Leonardo da Vinci, Michelangelo, Rubens, Raphael and Van Gogh”.

McKinney adds: “While the various stock, oil and other commodity markets ride the rollercoaster, fine art just keeps appreciating.”

He is not shy about revealing his plans to try to increase the value of the sapphire and the painting, both of which are expected to earn their keep in the meantime. The company, he says, plans “to develop the business and cashflows of the Millennium Sapphire and the Michelangelo masterpiece through games, branding and licensing”.

He will also “invite scholars and experts to examine and view the masterpieces, then tour them in worldwide exhibitions and documentaries” to generate a further revenue stream in the form of royalties and ticket sales. “We will also retain some of the world’s top art and promotions experts to develop and manage this once in a lifetime opportunity,” he says.