Behind the splashy headlines proclaiming record sums for works of art, a less eye-catching but more profound technological upheaval is taking place in the day-to-day business of continental European auction houses. Online sales and live-bidding, key tools for broadening client bases, are where the 21st-century auction battle is being fought.

While there are numerous online auction aggregators, such as the-saleroom.com, Invaluable and liveauctioneers, four out of ten of the largest continental European auction houses surveyed by The Art Newspaper have developed their own online-only auction platforms. Two more plan to do so this year. The 300-year-old Dorotheum in Vienna says 70% of its 700 auctions a year are now conducted online only. Munich-based Ketterer Kunst has been conducting online auctions since 2007, and created its own platform in 2013.

“It was clear to us that the internet represents the future for art auctions,” says Robert Ketterer, the owner and chief executive of Ketterer Kunst. “We were convinced that online auctions will fill the vacuum that inevitably emerges when numerous objects can no longer be offered in the auction room because of the logistics required and the high costs of catalogues.”

This development reflects broader trends in the retail industry, where high-street shops are disappearing as more and more sales take place online. According to figures from Eurostat, the EU’s statistics office, the ranks of e-shoppers are constantly swelling—about 80% of consumers in the Netherlands, the UK and Sweden purchase goods online. Ecommerce in Europe was expected to surpass €600bn last year. Shoppers are increasingly in the habit of buying across borders—and that applies to auction houses too.

“These are mega-trends,” says Jakob Dupont, the chief executive of Bruun Rasmussen in Copenhagen. “If we don’t understand that this threatens the normal way of running an auction house, we will end up as losers. We will see Facebook groups eating our business away beneath us.”

For now, online-only auctions tend to focus on the lower end of the market, and enable houses to reach a public that would not necessarily attend live auctions. The Zurich auction house, Koller, for instance, began holding online auctions on its own platform for items such as wine and fashion last year.

“We believe that a large part of the buying public is more attuned and open to this type of 24/7 auction, and these auctions will continue to gain in popularity and importance,” says Karl Green, the head of marketing at Koller.

Dupont says innovation online has helped Bruun Rasmussen become the market leader in the Nordic countries; the company now exports more than two-thirds of sales. “We have transformed from being a local Danish auction house to a global house,” he says. “We know the buying power is bigger outside Denmark and there is, for instance, huge demand for Danish furniture from the 1940s to 1960s in the US.”

Bruun Rasmussen has begun offering an integrated packing and shipping service for consignments from Denmark, including navigating customs for overseas purchasers. Clients can immediately see how much transport will cost when they place their bid. “Convenience is extremely important,” Dupont says. “Our clients have the money, but not necessarily the time.”

However, for now bricks-and-mortar auctions look set to continue as the sale platform for higher-priced items. Paris-based Artcurial, for instance, expects live auctions to remain its core business, despite the launch of a new online-only auction platform planned this year. And some auction houses, such as Kornfeld in Bern and Grisebach in Berlin, remain hesitant. Kornfeld is developing a new website this year with capacity for online-only auctions. “We see the potential above all for low-priced works,” says Bernhard Bischoff, a manager at Kornfeld. “But as our works are seldom below 1,000 Swiss francs, we are discussing the appropriate use for this.”

Though customers can bid online for “real life” sales at Grisebach in Berlin, the house has yet to introduce online-only auctions. “We think about it constantly,” says Sarah Buschor, a spokeswoman for Grisebach. “The big challenge here is to live up to our own high expectations in terms of personal and individual customer service, but also to underline the importance of seeing the original. It is a question of developing formats that ensure the online auction is a real and qualitative addition to our live auctions, and thereby generates new customers.”

As for the looming prospect of Brexit, European auction houses are uncertain about whether they stand to lose or gain from the UK’s departure from the EU. Artcurial sees the potential for Paris to expand its role as the art-market hub for continental Europe, which could benefit the auction house. Ketterer expects Brexit to weaken London’s role as the European art-market leader. “Above all, we think German consignors will consider whether they shouldn’t keep their wares in Germany,” Ketterer says.

On the downside, there will be increased bureaucratic complications and costs involved in taking works across borders if Britain is no longer in the customs union. “We will have more restrictions for selling art to the UK because lower limits for export licences apply,” Buschor says.

Here are profiles of ten of the biggest independent European auction houses, as surveyed by The Art Newspaper. Overall sales figures provided by the auction houses and those for top lots are given without fees and taxes, unless otherwise stated.

Artcurial’s sale of Surpreme streetwear memorabilia made $1m in 2018. Courtesy of Artcurial

Artcurial

Headquarters: Paris

Year founded: 2002

Total sales in 2018: €195.3m (includes commissions and VAT. Artcurial does not provide figures without them).

Top lot in 2018: Fishing Net Menders in the Dunes (1882) by Vincent van Gogh, sold for €6m.

Number of lots sold in 2018: 18,131

Core specialisations: French leader in Old Masters, newly developed urban art department, luxury goods such as watches and jewellery. Cars account for 27% of turnover.

Clients: 75% of clients are non-French, with collectors from Belgium, Germany, Italy, Austria, UK and US among the most prolific buyers.

The future: The company is launching a new platform in 2019 for online-only auctions. It is also seeking to further expand internationally, which may entail acquiring another business or opening new European representative offices in addition to current outposts in Brussels, Milan, Monte Carlo, Munich and Vienna.

Artemisia Gentileschi’s Lucretia, 1623-25 Courtesy of Dorotheum

Dorotheum

Headquarters: Vienna

Year founded: 1707

Total sales in 2018: Dorotheum does not publish sales figures. Artnet estimated 2018 sales at €71m.

Number of lots sold in 2018: About 700 auctions a year.

Top lot in 2018: Lucretia by Artemesia Gentileschi (1623-25), sold for €1.9m (including fees).

Core specialisations: Broad range of categories from cars to silver and antiquities to contemporary art.

Clients: International, predominantly from Europe and the US.

The future: About 70% of Dorotheum’s auctions are online-only and digital advancements remain a priority.

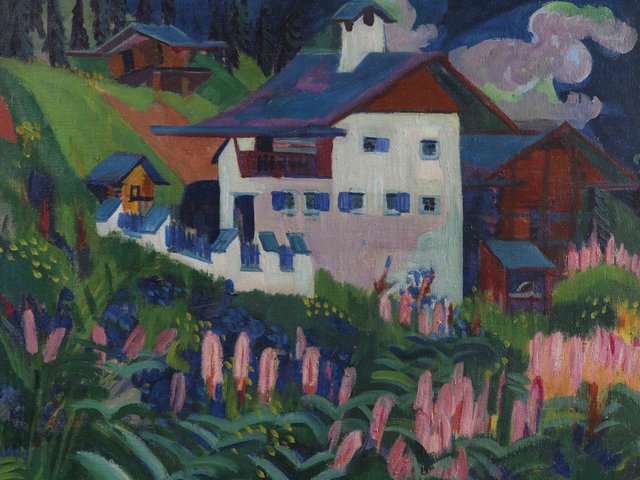

Autumn Clouds, Friesland by Emil Nolde, sold for €1.35m at Ketterer Kunst in 2018. Courtesy of Ketterer Kunst

Ketterer Kunst

Headquarters: Munich

Year founded: 1954

Total sales in 2018: €52m

Number of lots sold in 2018: 1,293 (excludes books)

Top lot in 2018: Autumn Clouds, Friesland (1929) by Emil Nolde, sold for €1.35m.

Core specialisations: Art from the 19th century to the present with a focus on German art.

Clients: Mostly from German-speaking countries, but also US, UK, Italy, France and other European nations.

The future: Ketterer Kunst was one of the first auction houses to introduce online sales in 2007 and created its own platform in 2013. It aims to continue expanding internet activities and recently announced the launch of the Ketterer Kunst Art Advisory Service, which aims to help corporations and private individuals to begin collecting art.

Breakfast Piece (1625) by Peter Claesz, whose works rarely appear on the auction market, sold for €650,000 in 2018. Courtesy of Bruun Rasmussen

Bruun Rasmussen

Headquarters: Copenhagen

Year founded: 1948

Total sales in 2018: €69m

Number of lots in 2018: Around 70,000

Top lot in 2018: Breakfast Piece by Peter Claesz, sold for €650,000

Core specialisations: Nordic art, Danish furniture design, and also stamps, wine and coins.

Clients: Nordic, other European, US and Hong Kong. Two-thirds of sales are to buyers outside Denmark.

The future: Wants to expand online business and improve service for online customers.

Jan Brueghel the Elder’s Village Landscape by the Water With Cattle Market (1613). Courtesy of Tomić-Hampel Fine Art Auctions

Hampel

Headquarters: Munich

Year founded: 1989

Total sales in 2018: €57m

Number of lots in 2018: 3,176

Top lot in 2018: Village Landscape by the Water With Cattle Market by Jan Brueghel the Elder, sold for €660,000.

Core specialisations: Old Masters and Impressionism.

Clients: German and international.

The future: The fine art auction house is trying to build its international client base, but has no plans at the moment for online-only auctions.

Desa Unicum’s Warsaw headquarters. © Marcin Koniak/Desa Unicum

Desa Unicum

Headquarters: Warsaw

Year founded: Desa was founded in 1950 as a state enterprise; partially privatised in 1991 and merged with Unicum Auction House in 1998.

Total sales in 2018: €18.8m

Number of lots in 2018: 2,310

Top lot in 2018: M 39 by Wojciech Fangor, sold for €930,000 (a record for the Polish auction market).

Core specialisations: Modern Polish art, particularly post-war avant-garde.

Clients: Primarily Polish, but increasingly international.

The future: Is aiming to develop pockets of the market such as Polish design and comic books and broaden its range of international clients. This year the company launched a new online mobile bidding application and plans to begin online-only auctions for low-end items this year.

Eduardo Chillida’s Elogio del aire (The praise of air, 1956) sold for €2.6m. Courtesy of Galerie Kornfeld

Galerie Kornfeld

Headquarters: Bern

Year founded: 1864

Total sales in 2018: €29.4m

Number of lots in 2018: 760

Top lot in 2018: Elogio del aire by Eduardo Chillida, sold for €2.6m.

Core specialisations: Old Masters, Modern and contemporary art, with a focus on Swiss art, prints and works on paper.

Clients: US accounts for 30%, a quarter are Swiss, 30% other Europeans, 10% Japanese and Chinese, and 5% from elsewhere.

The future: Kornfeld wants to embrace digital technology while keeping costs low, and is launching a new website this year with the capacity for a platform for online-only auctions.

Max Beckmann’s The Egyptian (1942), €4.7m. © Fotostudio Bartsch Berlin and courtesy of Grisebach

Grisebach

Headquarters: Berlin

Year founded: 1986

Total sales in 2018: €51.8 m

Number of lots sold in 2018: 2,536

Top lot in 2018: Female Head in Blue and Grey (the Egyptian) by Max Beckmann, €4.7m (a record for the German auction market)

Core specialisations: Art from the 19th century to the present, photography.

Clients: Up to 70% from Germany, the rest international.

The future: Grisebach does not hold online-only auctions yet, but is considering doing so in future.

This Chinese Ge ware dish sold for €900,000 in 2018. Courtesy of Lempertz

Lempertz

Headquarters: Cologne

Year founded: 1845

Total sales in 2018: €72.2m (includes fees, not sales tax).

Number of lots in 2018: Will not disclose, but held around 30 sales.

Top lot sold in 2018: Chinese Ge ware dish, sold for €900,000.

Core specialisations: Old Masters, Modern and contemporary art.

Clients: Mostly non-German, European and international.

The future: Developing cooperation with Artcurial in Brussels and Monaco auctions. Starting in 2019, Lempertz will collaborate with Artcurial ifor African and Asian art sales in Brussels. It has no plans for online-only auctions.

Rouge et Jaune (L’Egyptienne, 1910-11) by Kees van Dongen Courtesy of Koller Auktionen

Koller Auktionen

Headquarters: Zurich

Year founded: 1958

Total sales in 2018: around €60m

Number of lots in 2018: 7,500

Top lot in 2018: Rouge et Jaune (L’Egyptienne) by Kees van Dongen, sold for CHF1.5m

Core specialisations: Modern and contemporary Swiss art.

Clients: Koller Auktionen has a core base of Swiss clients, but international collectors also buy here.

The future: Koller began conducting online-only auctions for objects in the low-to-middle price range in 2018 and expects this segment of its business to grow.