Ten years ago, on 15 September 2008, Damien Hirst sold £70.5m of his own work at Sotheby’s in London, a ballsy move by an artist, bypassing the usual middle-men. The same evening, Lehman Brothers filed for Chapter 11 bankruptcy in New York and the Dow Jones fell by 500 points, triggering an implosion of global stock markets.

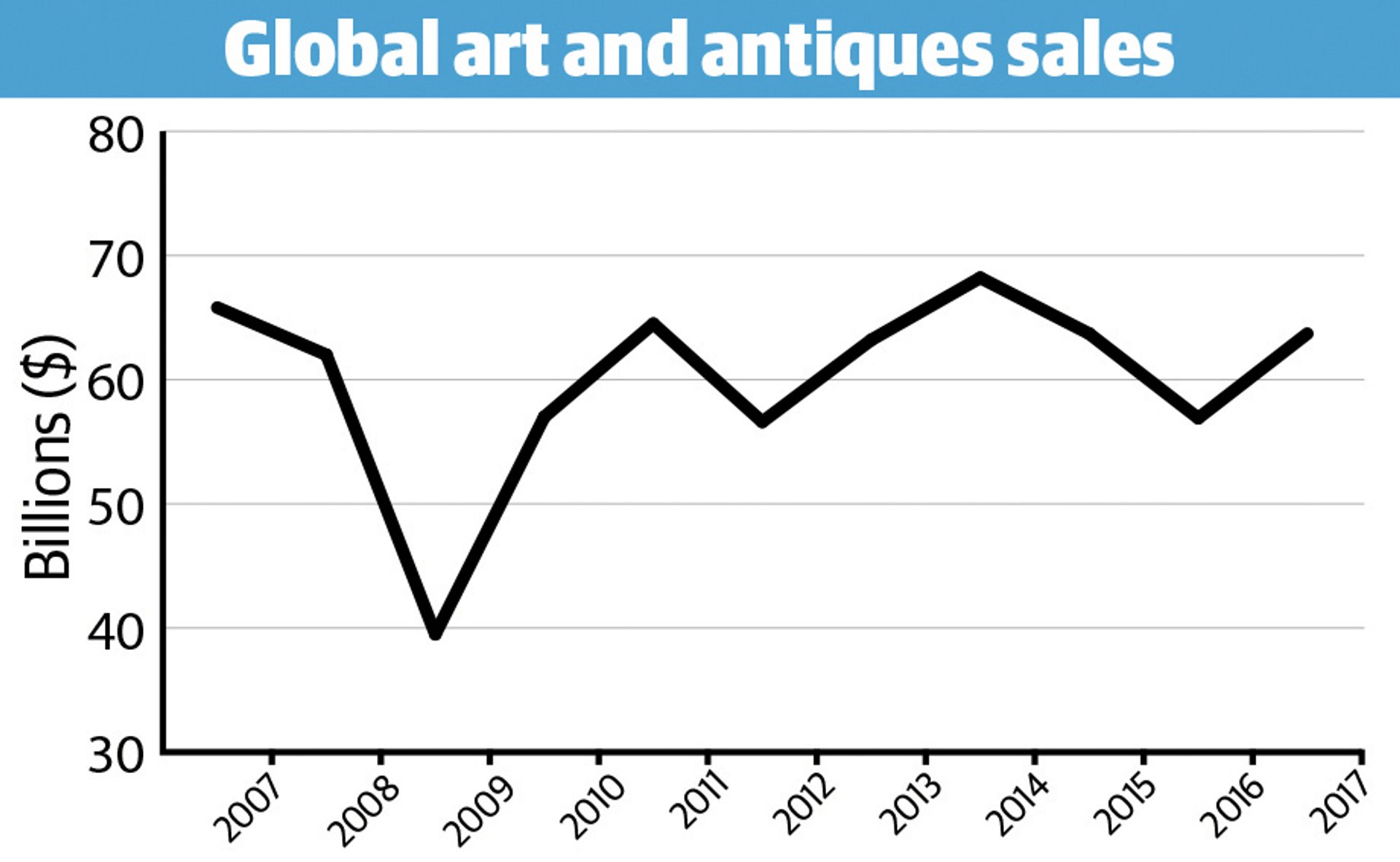

Hirst’s sale, mawkishly (or perhaps ironically) titled Beautiful Inside My Head Forever, totalled £111.4m over two days, and became an emblem of the decadent pre-recession contemporary art market. Then came the sober years—global art and antiques sales, calculates the economist Clare McAndrew, fell from $62bn in 2008 to $30.5bn in 2009. Even in 2017, at $63.7bn total sales were still 3.2% lower than the $65.8bn in 2007.

Yet, the speed of the art market’s recovery post-recession was remarkable. Despite falling 40% between 2007 and 2009 – one of the biggest declines since the early 1990s, MacAndrew says – it bounced back in 2010, largely due to the emerging Chinese market. “Following the 1990s crash, it took about 15 years for the market to get back to its late 1980s, pre-recession levels as it was just dependent on demand from the US and Europe,” she says. Market durability lies in a broad footing after all.

Contemporary art’s Rococo

Alex Rotter, Christie’s chairman of post-war and contemporary art for the Americas, refers to the pre-Lehmans boom as “the Rococo of contemporary art”. He recalls the November 2008 and spring 2009 auctions (when he was at Sotheby’s) as “gruesome: everyone lost money, people were dumping guarantees left right and centre”. In 2009 he says, “volume was down 60-80%, and sale totals fell from around $500m to around $100m”.

Certain artists whose markets were booming pre-recession are tainted by association. Hirst, of course, but Rotter adds Jeff Koons, Richard Prince and Takashi Murakami: “Their prices are still struggling to get up to the levels of 2007-08.” According to the analysis firm ArtTactic, all of the top ten prices for Hirst’s work were recorded in 2007-8, six of them during Beautiful Inside My Head Forever. Lullaby Spring (2002), which sold at Sotheby’s London in 2007 for £9.6m ($17.2m, with fees), remains Hirst’s auction record in dollars, and was then a record for a living artist.

Some collectors who bought at the top of the Hirst market remain aggrieved—works that have come back to auction have had shaky results. For example, Midas and the Infinite (2008), a butterfly painting, sold in 2008 for £825,250 ($1.2m), then in 2011 for £601,250 ($790,376, down 37%) and last year, in Hong Kong, for HK$7.9m ($836,438, down 33% from 2008).

“There are still those who think they overpaid then for their spot painting or shark,” Rotter says, “but this is a long game and Damien is not a one-trick pony—he’s been making since the 1980s. Those sharks and spots will be in all the art history books.”

In step with technological innovation, fashions are changing ever faster. “Market shifts have accelerated,” Rotter says, “For example, in 2014-15 minimalists like Agnes Martin and Donald Judd were in vogue. Now, it’s the opposite—colourful, figurative paintings, hence the revival of Cecily Brown, who no one was looking at for ten years.” Figuration and abstraction, Rotter says, “always relieve each other. There will probably be a swing back to abstraction soon.” That said, Rotter thinks the crash “opened people’s eyes to the fact something happened before 2000. Top collectors are not as segmented in their view anymore.” He should know—Rotter was bidding for the buyer of the Salvator Mundi.

Shifting tastes aside, overall post-war and contemporary art has leapt in value. Peter Gerdman, ArtTactic’s head of research, says: “Average prices for works sold during evening sales have risen 413% in London between February 2009 and March 2018, and 373% in New York between May 2009 and May 2018.” Two of the biggest movers, Gerdman says, are Jean-Michel Basquiat—whose highest price was $5.8m (with fees) up to 2009 climbing to $110.4m in 2017—and Christopher Wool, whose high was $1.8m in 2009 compared to his current record of $29.9m in 2015 (all with fees).

Data courtesy of Arts Economics

Recovery and acceleration

The accelerated financialisation of the art market has defined the post-Lehmans decade, as indicated by the growth of the art financing industry, the building of freeports for tax-free storage of art, and development of financial products such as auction guarantees (still quite rare in 2008, now ubiquitous).

Financialisation, according to Amy Cappellazzo, the chairman of Sotheby’s fine art division, is “the next stage of any marketplace once it starts to attract big capital… an inevitability that comes with growth”. Increasingly, she says, collectors are paying with borrowed capital—“20 years ago there was none of that, ten years ago there was very little”. Fractional ownership of art, she thinks, will also become much more common.

Initially developed to allay risk, ironically Christie’s and Sotheby’s in particular have become beholden to their guaranteeing system as they compete with each other for top-end consignments. A squeezed commission margin on two guaranteed paintings dented Sotheby’s 2018 half-year earnings—Modigliani’s Nu couché (sur le côté gauche) (1917), hammered down on one bid to the third-party irrevocable bidder for $150m in May, and Picasso’s 1932 Buste de Femme de Profil (femme écrivant), which was guaranteed in-house and had an irrevocable bid, but sold under the $45m estimate on a single bid of £27.3m ($36m) in June. Both deals, evidently, cost Sotheby’s.

Anders Petterson, the founder of ArtTactic, thinks the 2009 crisis helped to elevate art “to an alternative asset class for wealthy individuals who were looking for asset protection and diversification, as well as emotional and social returns”. Banks, he adds, “are increasingly offering loans against art, enabling more capital to be freed up”. A cuddly relationship with the finance world could be a double-edged sword. An increased dependence on the financial markets, Petterson says, is “a trend that I believe will shape the art market over the next decade, both in terms of opportunities as well as heightened risks”.

Lehman Brothers’ New York headquarters, before the collapse Edgar Zuniga Jnr

The future: Asia and data

The exponential accumulation of price data over the past decade has contributed to art’s asset class status. “The more data you have, the clearer the trend lines for deciphering which artists are hot,” Cappellazzo says. “Data won’t supplant academic knowledge and a keen eye, but it is a useful analysis tool.” Working out how to leverage that data remains the challenge. Blockchain, which was itself invented in 2008 (see p54-55 for more), will “transform the market” Cappellazzo says, although “for it to work, it requires everyone to comply and offer up their data”.

Still, speculative investment in emerging art is risky. “I think in a few months there will be a hard reality check for those who have been buying young artists who haven’t had steady price development,” Rotter warns. Canice Prendergast, a professor of economics at the University of Chicago’s Booth School of Business, says: “I’m surprised how long it took collectors to realise that investing in emerging art is, for the most part, a hiding to nothing… the recent closure of lots of smaller galleries is a reflection of this.”

While auction houses bemoan lack of supply on the secondary market, at the emerging end supply outstrips demand and, Prendergast predicts, “a significant correction”.

As the axis of power and wealth tilts away from the West, all agree that the future lies in Asia. “The rise of China is the single most important thing that has happened in the world in my lifetime,” Prendergast says. Despite President Trump’s tariff on Chinese goods, China, and Asia as a whole, can only become more powerful in every market. The West is in the late stages of an economic boom and when the next crash comes—and it will—Asia may prove a saving grace, for the art market at least.