A rare painting from René Magritte’s famous L'empire des lumières series is estimated to sell for more than $95m at Christie’s New York this autumn, a sum that would break the Surrealist artist’s record at auction and represent a major win for the auction house after softened sales across the industry.

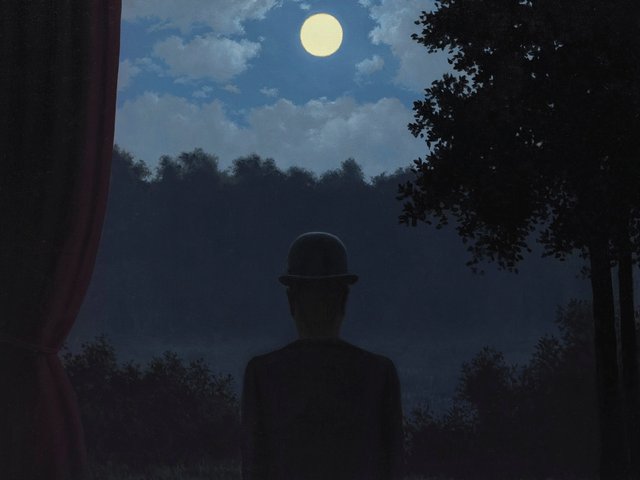

L'empire des lumières (1954) is one of the 27 paintings in which Magritte explored light by painting a sunlit sky above a darkened street scene. In 2022, another one of the works from the series nearly tripled Magritte’s previous record when it sold for £51.5m (£59.4m with fees) at Sotheby's in London.

Who owns the painting now?

The present painting comes from the estate of the late Mica Ertegun, an interior designer who was married to Ahmet Ertegun, a co-founder of Atlantic Records, and a prolific art collector. Other works to be included in the sales of her collection include pieces by household names like Joan Miró, David Hockney and even a Polaroid photo of Ertegun herself taken by Andy Warhol.

“But of all the works she lived with, Magritte’s L'empire des lumières most nearly captures her aesthetic philosophy in its balance and restraint,” Max Carter, Christie’s vice chairman of 20th and 21st century art, said in a statement. “An icon of Surrealism, the Ertegun Magritte is arguably the finest, most deftly rendered and hauntingly beautiful of the series. Like Mica’s eye, it is perfect.”

When will it go on sale?

A dedicated evening sale of Ertegun's collection will be held on 19 November in New York, along with subsequent day sales and two online sales. A "significant portion" of the proceeds will go toward philanthropic initiatives, an auction house spokesperson said. During her life, Ertegun supported causes like the Graduate Scholarship Programme in the Humanities at the University of Oxford, Jazz at Lincoln Center and the World Monuments Fund.

Christie’s reported in July that its total revenue from live and online auction sales during the first half of 2024 had reached $2.1bn worldwide, representing a 22% year-on-year drop and roughly $600m less than the opening six months of 2023. However, other metrics like sell-through rates, remained healthy. Last week, the auction house revealed it is acquiring Gooding & Company, a collector car auctioneer, 17 years after exiting the car market.