Three UK nationals have been charged with conspiracy to commit wire fraud and money laundering for allegedly defrauding investors with a series of Evolved Apes NFTs (non-fungible tokens).

According to the indictment, which was published late last week by the United States Attorney for the Southern District of New York, the defendants (Mohamed-Amin Atcha, Mohamed Rilaz Waleedh and Daood Hassan) orchestrated a so-called “rug pull” scam in 2021, a known fraudulent tactic in which developers advertise a digital offering, collect funds from purchasers and then abandon the project while keeping the funds.

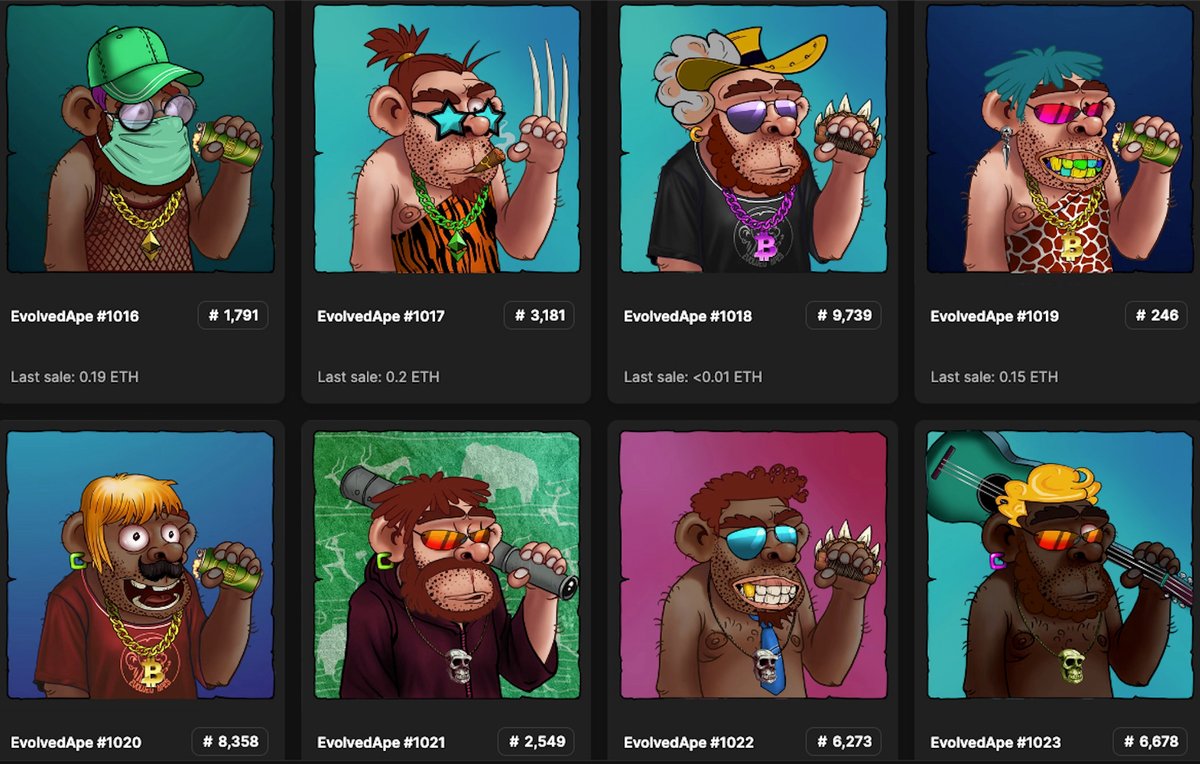

The trio (all 23 years of age) allegedly created and promoted the Evolved Apes NFTs, which featured around 10,000 digital images of cartoon apes, promising to use the funds raised to develop a video game based on the tokens, which would, in turn, increase the assets’ value. (The Evolved Apes tokens are of a similar aesthetic style and sensibility to the wildly popular Bored Ape Yacht Club NFT series.) Ultimately, the digital game was not completed and the defendants are alleged of shutting down the Evolved Apes site and pocketing the proceeds (detailed at more than $2m in the indictment) through cryptocurrency transactions to their personal accounts. (As of this writing, 9,870 Evolved Apes are still listed on the NFT trading platform OpenSea.)

“Digital art may be new, but old rules still apply; making false promises for money is illegal,” US Attorney Damian Williams said in statement. Each individual is charged with one count of conspiracy to commit wire fraud and one count of conspiracy to commit money, with each charge carrying a maximum sentence of 20 years in prison. Attempts to contact the defendants or a legal representative were unsuccessful at the time of publishing, and it is unclear how they will plead. It has also not been verified whether the individuals were US residents at the time the charges were filed.

The case, which is being handled by the Illicit Finance and Money Laundering Unit of the US Attorney’s Office for the Southern District of New York, demonstrates increasing efforts to pull crypto cases into the main arm of the law.

“For a while lots of NFT projects pitched themselves as raising capital for the building of another business such as the development of a game,” says Jon Sharples, a senior associate at Howard Kennedy. “Whilst that will often engage quite technical securities law issues, this is a reminder that the plain old law of fraud can apply where promises have been made with no intention of keeping them.” Sharples adds that the use of terminology, such as “rug pull”, within an official communication like this was also telling of the authorities’ increasing interest and familiarity with developments in the cryptocurrency and NFT spaces.

This is not the first rug-pull case to hit headlines. Figures released by the security app De.Fi last year suggested that cryptocurrency users lost over $1.95bn to rug pulls in 2023. Nor is it the first instance of criminal charges being brought by US authorities for an alleged rug pull, with other examples including two men charged over a comparable scheme in 2022, which is believed to have earned around $1.1m through a series of tokens known as Frosties.

“The very nature of NFTs means they don’t respect traditional boundaries and so alleged NFT frauds will inevitably cross many jurisdictions in terms of the tech, architects [and] investors,” says Nicola Finnerty, a partner at Kingsley Napley. She adds that increased regulation and enforcement will require “authorities being equipped to detect, properly investigate and understand modern technologies—[which] comes back to resourcing and appropriate policies”.