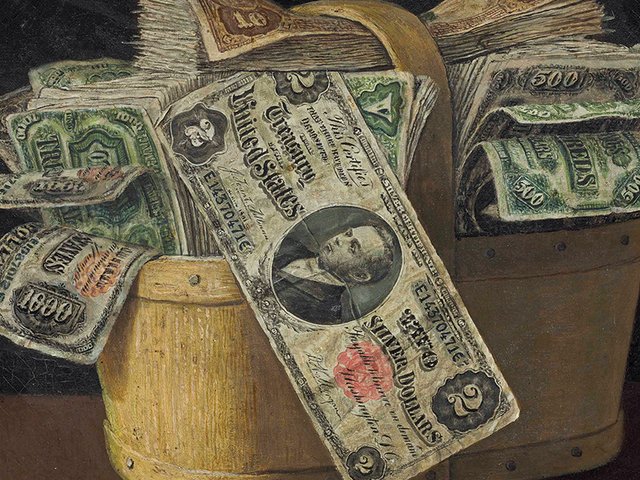

Despite the growing ranks of buzzy painters taking their work beyond figuration, no artist is doing as much to push art into an unprecedented realm of abstraction as art-finance companies. The process began when high- and ultra-high-net-worth individuals started taking out loans collateralised by works of art decades ago, and it has shifted into high gear now that those same art-backed loans are being bundled, securitised and sold as investment vehicles to US buyers.

The movement reached a new milestone this April, when Sotheby’s announced it would raise $700m through an offering officially known as Sotheby’s ArtFi Master Trust, Series 2024-1 Asset-Backed Notes. The security has so far spawned far more coverage in the financial press than in the art press, which should surprise no one given that most people who read and write about works of art would (understandably) rather try to digest an actual stack of Post-it Notes than the arcane minutiae in an investment prospectus. But it is precisely because so many art professionals find the securitisation of art-backed debt so alien and so off-putting that it is so important to wade into its inner workings and larger implications for an industry vocal about its need to expand.

The ABCs of SFS

To understand Sotheby’s new security, one first has to understand what Sotheby’s Financial Services (SFS), the auction house’s lending arm, has been doing since its founding in 1988. The simple answer is that SFS primarily makes two types of loans, with the collateral in both cases being one or more works of art owned by the borrower. (SFS also writes loans backed by several other categories of what its website terms “passion assets”, including jewellery, watches and classic cars. But since its $700m security strictly deals with works of art, this is the last time I’ll mention anything else.)

The majority of SFS’s loan book—meaning, the full portfolio of loans it has made—consists of art equity loans. In exchange for a lump sum paid up front, the borrower in these arrangements agrees to make regular payments to SFS at a given interest rate, normally for one to two years. In its second category of loans, called consignor advances, collectors receive cash up front for one or more works that they have consigned to Sotheby’s for eventual sale, either at auction or privately; in these cases, interest is due when the loan term of 12 to 15 months ends, and the consignor must repay the full amount owed before they receive any remaining proceeds from the sale itself.

SFS is set up to finance between $1m and $200m per loan, with the amount equalling, on average, around 50% of the appraised value of the work(s) used as collateral. This range ensures that SFS exclusively deals with works of art with blue-chip valuations. For example, if I owned a knockout Kerry James Marshall painting appraised at $10m—or alternatively, a group of lesser works collectively appraised for the same amount—the chances are good that I could pledge them to borrow $5m from SFS. (By the same token, I would be wasting everyone’s time by approaching the firm with any piece or group of pieces appraised for less than $2m.)

The key point is this: whether through an art equity loan or a consignor advance, SFS pays out a smaller amount of money now on the condition that the borrower either repays a somewhat bigger amount over time or, if they default, gives Sotheby’s ownership of the work or works backing the loan. This means each of these loans constitutes a revenue stream of a largely knowable amount for Sotheby’s. If all goes well, the money will come from the scheduled cash payments made by the borrower. If not, the money will come from the proceeds of selling their collateral.

So, SFS has a very good idea of how much money it will generate from each loan no matter the outcome. By building up hundreds of such loans, SFS has accumulated hundreds of revenue streams that, when pooled together, mean the firm is owed hundreds of millions of dollars in regular payments over the medium term, backed by hundreds of millions of dollars worth of art that its parent company knows how and where to sell if necessary. The company’s loan book had grown to around $1.6bn by 31 December 2023, and it has written more than $10bn in loans since 1988.

Securitisation blanket

Neither art equity loans nor consignor advances are new to SFS. What is new to the outfit, however, is its securitisation of those loans. Conceptually, what SFS has done is to bundle a large number of its smaller individual loans into a kind of super loan—one that returns super payments made up of all the revenue streams from the underlying loans, whether in the form of interest and principal payments or sales of collateral (that is, art).

Using this new vehicle, SFS then inverted its usual modus operandi by borrowing a lump sum of $700m from a group of major investors. As collateral, it has put up the largely knowable sum of money it is owed from the super loan—which is actually made up of 89 art equity loans and consignor advances backed by more than 2,800 works of art collectively worth around $1.4bn.

The upshot is that Sotheby’s gets a meaningful injection of capital now in exchange for the revenue it would have derived from a large portion of its loan book over time had it been content to sit back and wait. A report from the ratings agency Morningstar DBRS states that investors will be repaid the original $700m by 22 March 2027 and the total interest by 22 December 2031.

Patrick Drahi Photo: REUTERS/Violeta Santos Moura

This looks like a boon for Patrick Drahi’s larger corporate empire, which needs both serious cash and serious cojones to work its way out from underneath debts totaling around $60bn. For reference, $700m is around 20% of the $3.7bn Drahi agreed to pay for Sotheby’s in 2019—enough that he may no longer be inclined to sell a minority stake in the auction house, as had been rumoured since last year (and as I had predicted in January).

A Sotheby's spokesperson denies there is any connection between SFS and debts held by Drahi's other properties. "The SFS securitisation is unrelated to Sotheby’s balance sheet or to debt held by Drahi in connection to other business ventures," the spokesperson says. "The offering will allow further investment opportunities into SFS."

But to grasp the implications of the SFS security beyond Sotheby’s own finances, it helps to compare the offering with its only competitor.

Different players, different strategies

Although Sotheby’s and SFS made a big splash with their $700m security, they are not the first to sell bundled art-backed debt as an investment vehicle. That distinction goes to Yieldstreet, the US-based private market platform for alternative investments that acquired specialty lender Athena Art Finance in 2019.

Yieldstreet launched the first of its “diversified art debt portfolios” that same year. Each of these offerings has been broadly similar to SFS’s security: a package of loans backed by works of art whose combined interest and principal payments serve as the collateral used to raise capital from third-party investors. Yieldstreet has offered eight such portfolios to date. Five have fully matured (meaning, reached the end of their term with the principal and interest repaid); one is no longer accepting investments; the other two are still open as of this writing.

Despite their macro similarities, however, there are some important differences between Sotheby’s security and the comparable offerings from Yieldstreet. The first is scale. Although a Yieldstreet spokesperson declined to comment on the capital structure of its open art debt portfolios, citing compliance reasons, outside investors only financed around $10m and $32m, respectively, in two of its early securities—a fraction of the $700m raised by SFS in April, and more in line with the $750m in art-backed loans written by Athena since 2015.

The gap originates in part from the second distinction between the two firms’ offerings: who had the option to invest in each one. The only parties eligible to buy into SFS’s security were what is called qualified institutional buyers, each of which controls at least $100m worth of securities overall. Examples include pension funds, mutual funds and insurance companies.

Partly as a result of the vast resources managed by qualified institutional buyers, the US’s financial regulatory infrastructure assumes that these entities have a high level of sophistication about investing and, therefore, need less protection than, say, individual day traders staking their life savings on whatever prognostications they just read on Reddit’s Wall Street Bets forum. This means qualified institutional buyers are permitted to take positions in offerings that no one else can, such as SFS’s security, in which they tended to invest tens of millions of dollars each, according to an SFS representative.

Those traits stand in stark contrast to the identities and investment requirements of Yieldstreet’s art debt clientele, according to Rebecca Fine, the chief executive of Athena Art Finance and the managing director of art investments at Yieldstreet. “We’re making this available to the mass affluent,” she says. “We do have some institutional investors, but generally speaking, our investors are high-net-worth individuals and ultra-high-net-worth individuals.” The minimum investment amount for Yieldstreet’s open art debt portfolios is $10,000—substantial, but still orders of magnitude smaller than the amounts the average qualified institutional buyer funnelled into SFS’s security.

Despite the differences in their models, however, Fine sees SFS’s $700m offering as proof of the shared concept. “This should put to bed any questions of whether or not art is a credible asset class. At a minimum, it’s a powerful demonstration that there is a strong demand for art loans,” she says.

Removal service

The art-backed debt offerings from SFS and Yieldstreet also converge on another point: both require investors to operate at the same remove from the specifics that could ground their investment in the day-to-day realities of the art trade. Asked what potential investors tend to want to know about Yieldstreet’s art debt portfolios, Fine says: “We’ve had questions from time to time about who the underlying borrowers are, and we explain that, for reasons of privacy and confidentiality, we do not disclose any information about the borrowers or about the underlying artworks other than the concentration of a particular artist in a given loan portfolio.”

SFS follows similar guidelines. The Morningstar ratings report for its security breaks out the collateralised art in the loans in generalised ways—for example, showing what percentage of the works fall into which artistic category (such as contemporary, Impressionist and modern or Old Master), occupy which estimate bracket (such as between $10,000 and $100,000, or $50m and above) and are physically housed in which types of buildings (such as residences, storage facilities or exhibition venues).

Pre-sale documents obtained by the Financial Times went slightly further (with the caveat that they corresponded to SFS’s original plan to price the offering at $500m, not the final $700m). They specified the five artists behind the works responsible for the largest shares of the collateral pool by value—in descending order, Rembrandt, Andy Warhol, Pablo Picasso, Jean-Michel Basquiat and Frida Kahlo—as well as what share of the underlying loans’ total value went to the top five borrowers—though their identities were, of course, anonymised.

I realise that for many (if not most) readers interested primarily in art and artists, trying to retain details like the ones in the previous few paragraphs feels as impossible, and perhaps as pointless, as trying to memorise the reflections in a diamond. But the challenge itself speaks to why art professionals and enthusiasts should care about the packaging, securitisation and sale of art-backed debt.

There is a chasm between understanding these types of fine-print financial abstractions and understanding precisely which works and which people are at the foundation of the underlying art loans. The distance means that potential investors must base their decisions almost entirely on arms-length data provided by an intermediary who necessarily knows more than they do: here, Sotheby’s, whose own experts appraise the market value, condition and authenticity of the works that SFS writes loans against (except in atypical situations); or Athena Art Finance, which contracts with reputable third parties to oversee these matters for the art-backed loans bundled, securitised and sold by Yieldstreet.

At least a few of the qualified institutional buyers who added SFS’s security to their portfolios undoubtedly have corporate art collections, but the actual money managers who said yes to the offering probably only interact with those collections insofar as they see a few pieces on the walls every time they go into the office. Fine, meanwhile, says that Yieldstreet and Athena create opportunities for their investors “to engage with artists and curators and advisers” that can compel them “to explore art on their own”. But in general, these same investors tend to buy into Yieldstreet’s diversified art debt portfolios because they “have a desire to include art as a means of further diversifying their private market alternative investment strategy”, she says, adding that “many” of them “may have collections of their own, but for the most part, they are not art collectors”.

Judgment days

I suspect that this development makes art purists want to retreat to a commune, sledgehammer the windscreens of any car that costs more than the national median wage of their home country, or both. Even the harshest critic of traditional art speculators has to admit that they still have to circulate, to some minimal degree, within the ecosystem that art and artists sustain. Otherwise, how would they get the requisite knowledge about the paintings they are speculating on, the surrounding socioeconomic networks that give those paintings the potential to appreciate in value and the market cycles that dictate when to buy and sell them?

None of this is necessary for the investors in art-backed debt securities. In fact, because of the earlier-mentioned confidentiality requirements, past a certain point it is not even possible for the investors to know the specifics of what, exactly, underlies the securitised art debt vehicles they are staking. The situation is even more extreme than the one created on fractional investment platforms like Masterworks and Showpiece, where buyers at least know specifically which works they are buying into, as well as how, when and by whom those pieces were acquired.

Instead, forming a relationship with any work of art, any artists and almost any definition of “the art world” remains fundamentally optional for investors in art-backed debt securities. These things can all exist purely as abstractions that give rise to the numbers, charts and disclaimers in an investment prospectus, keeping them as notional as, say, the hundreds of home loans bundled into a mortgage-backed security, the actual houses functioning as their collateral and the people who call each of those houses their home.

So yes, SFS’s art-backed debt security confirms high-value art’s legitimacy in the eyes of the institutions whose actions determine what is, and is not, an asset class: the ratings agencies, the money managers, the pension funds and other qualified institutional buyers. But past precedents suggest that relatively few artists, art enthusiasts and even art professionals consider this a good thing. To the majority, seeing art used as loan collateral, let alone being securitised to the tune of $700m, is like hearing one of their favourite underground band’s songs used in a luxury watch commercial—proof that corporate interests are in the midst of smuggling something sacred to an unworthy audience that is only interested at a grubby surface level.

At the same time, there is also a widespread belief among these same art-world constituencies that fine art has to widen its reach quickly, and that it is impossible to do this without leaving behind some of the judgments and pretensions about who is allowed to engage, and how. Like them or not, art-backed debt securities verify that new audiences are indeed connecting with art, even if only the most reliably marketable kind via the most abstract, financialised routes yet. If you see this as an existential threat to the bottom-up ecosystem of emerging galleries, mid-career artists and a life lived among images and ideas, then it may be time to ask whether it matters more to expand access to art by any means necessary, or to retain the power to say, “No, not like that.”