The UK government has handed a lifeline to museums and galleries by extending a scheme which allows institutions to claim tax relief on costs linked to setting up an exhibition. However, the overall budget for the UK department of culture, media and sport has decreased from £1.6bn for 2023-24 to £1.4bn for 2024-25.

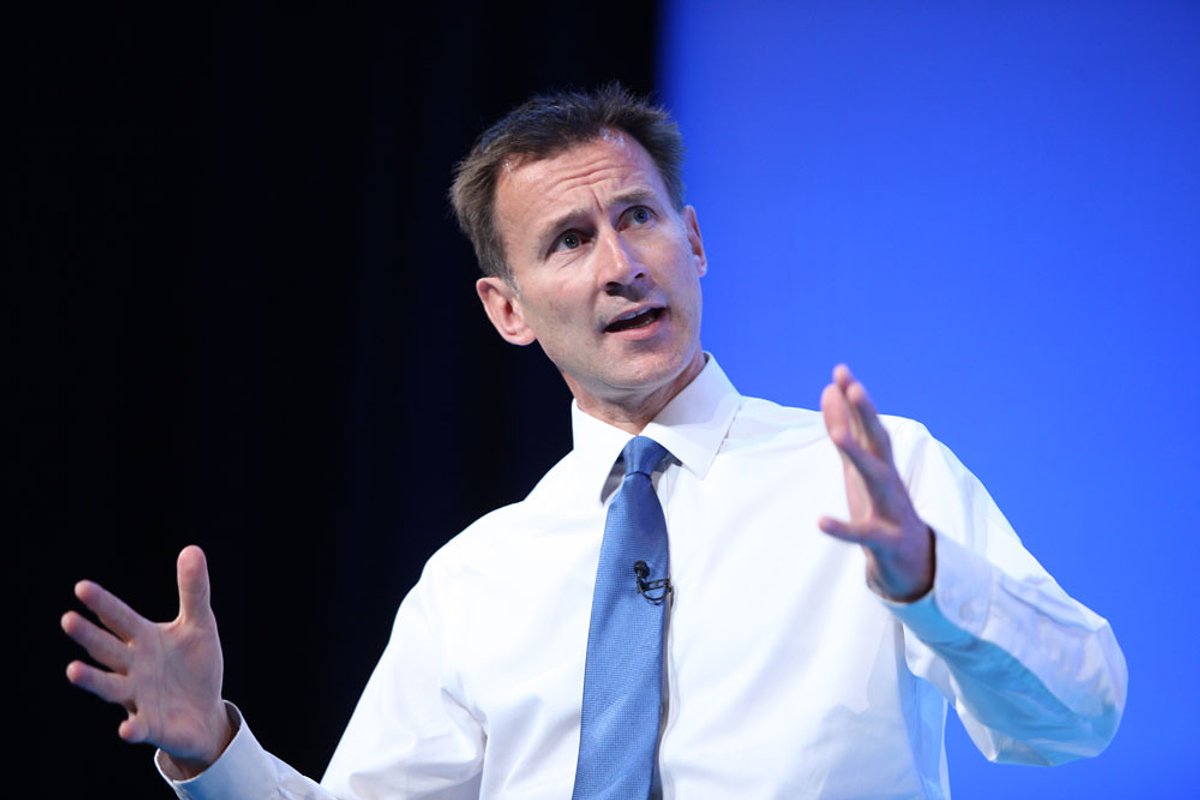

The Museums and Galleries Exhibition Tax Relief (MGETR) was due to expire April 2026 but the chancellor, Jeremy Hunt, confirmed in his budget statement (6 March) that it will be made permanent.

The measure enables museums and galleries to claim back tax on the costs associated with setting up an exhibition, including production, installation and deinstallation if the exhibition lasts a year or less.

According to the UK Museums Association, the MGETR will provide a higher rate of 45% tax relief for touring productions and 40% relief for non-touring productions for the financial year 2024-25, with the maximum cash repayment per exhibition capped at £80,000 and £100,000 respectively.

“The tax relief has supported 6,430 exhibitions of all sizes, from blockbuster exhibitions that draw huge national and international audiences, to the creation of more ambitious new displays at smaller museums that engage local communities around the country,” says a statement by the National Museum Directors’ Council, which represents the leaders of UK national collections and major regional museums.

Jenny Waldman, director of Art Fund, adds in a statement: “It [MGETR] is a critical support for the vitality and ambition that museums and galleries bring to the cultural life of the UK, so we are delighted that it has been made permanent.”

The National Railway Museum in York and National Museums Liverpool also received funding in the spring budget for capital projects as part of the government’s “levelling up” project. Liverpool received £10m for its Waterfront Transformation project which involves the transformation of the International Slavery Museum and Maritime Museum.