Six months on from the New York auction cycle that confirmed financial discipline had returned to the art market’s high end, trade professionals are wondering whether purse strings will be looser for the offerings in November’s major sales. Christie’s, Sotheby’s and Phillips’s Frieze Week auctions in London suggest that the answer is probably not, but also that the story of the market this autumn is more nuanced than a mass retreat to tried-and-tested names.

For proof, look no further than the anchor lot of Sotheby’s Contemporary evening sale in London on 12 October. Gerhard Richter’s Abstraktes Bild (1986), estimated at £16m-£24m without a financial guarantee, passed at £14.5m. The result almost singlehandedly left the sale total of £30.1m (including fees) nearly 25% beneath the house’s revised low estimate of £39.9m, after five lots by blue-chip artists—some also guaranteed—were withdrawn pre-sale. (One other lot, a Glenn Ligon text canvas with a £700,000-£1m estimate range, failed to sell.)

“It really isn’t a surprise. This is the way things have been going for the last six months. The market is difficult,” said a French dealer at the end of the night.

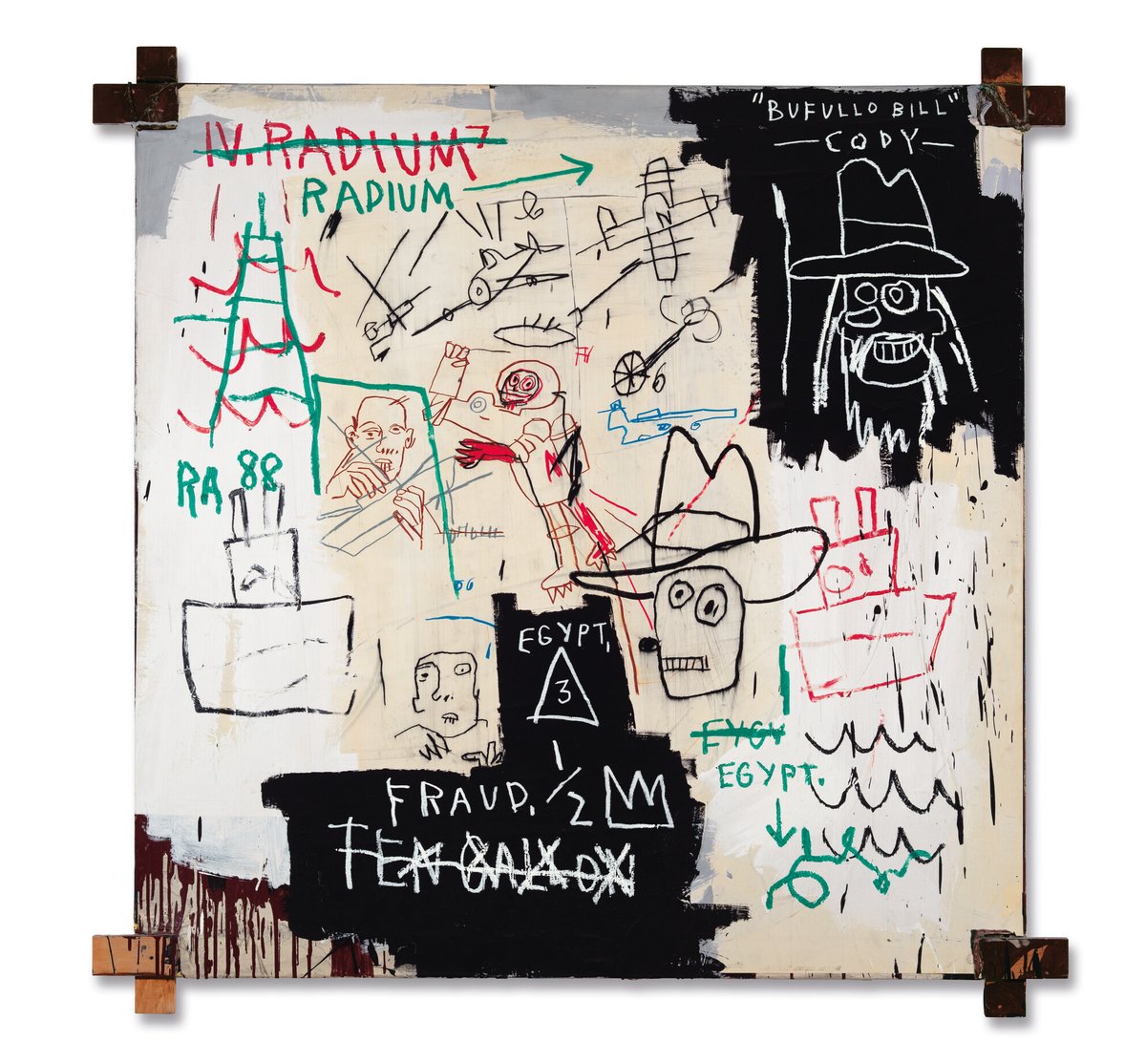

Although the premier works in Christie’s evening sale of 20th- and 21st-century art and Phillips’s evening sale of 20th-century and contemporary art found buyers on 13 October, neither exceeded their low estimate. Jussi Pylkkänen, Christie’s president and co-auctioneer on the night, knocked down Jean-Michel Basquiat’s Future Sciences Versus the Man (1982) at £8.8m (£10.4 with fees), just shy of its £9m low expectation. At Phillips, Banksy’s Forgive Us Our Trespassing (2011), hammered at its low estimate of £2.2m (£2.7m with fees).

Phillips withdrew the lot with its sale’s second-highest expectation, Lucio Fontana’s 1964-65 slashed canvas Concetto spaziale, Attese (est £1.4m-£1.8m), along with five other works by blue-chip names. The withdrawn sextet’s combined low estimate was £3.7m, meaning the £14.5m hammer total for the remaining works fell short of the sale’s original £17.6m low estimate by 17.6%.

Every lot scheduled to be offered in Christie’s evening sale of 20th- and 21st-century art did indeed cross the block, but six failed to sell, with half of those made by canonical artists: Fontana, Yayoi Kusama and Andy Warhol. The sale stepped over the house’s £39.4m pre-sale low estimate after fees lifted the £36.4m hammer total to a premium-inclusive tally of £44.6m.

Perhaps equally contrary to simplistic market narratives were muscular performances by several ultra-contemporary artists. The Now evening sale, Sotheby’s auction dedicated to the freshest faces, made £15.5m (with fees) from 21 lots, above the revised £13.6m pre-sale high expectation. Lots by six artists born in 1977 or later topped their respective high targets after fees. Works by ten artists in the same age group outperformed their high estimates after fees at Christie’s the following night, and nine more did so at Phillips.

Conventional wisdom upended

Meanwhile, the lone lot withdrawn from The Now carried its highest pre-sale expectation: By a River (est £3m-£4m) by Peter Doig, arguably the safest name in the sale based on the conventional wisdom about buyer psychology in a market correction.

But with the exception of the record-setting £2.95m (with fees) paid for Lynette Yiadom-Boakye’s Six Birds in the Bush (2015) at The Now auction, the highest price for an ultra-contemporary work during the Frieze Week auction cycle was £565,150 (with fees) for a painting by 41-year-old Caroline Walker in Phillips’s sale. That is a far cry from November 2022, when works by multiple ultra-contemporary artists sold at auction for more than $1m.

It would be naïve, given the market’s realities, to assume that every strong auction result for an artist aged 46 or younger reflects organic demand, whether this autumn or any other season. Dealers, particularly those with substantial means, routinely bid up lots by artists in their programmes, never more so than when those artists have little to no history under the hammer.

Still, the Frieze Week auction cycle suggests that the price of a work has become at least as important as the prestige or the potential of its maker. Even in a down market, canonical names can still be overestimated when buyers are looking for a sure thing, and largely unproven artists can still be too enticing to ignore.