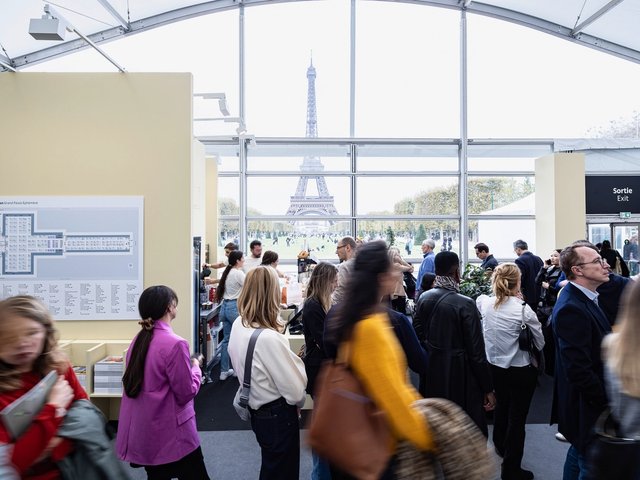

Amid a tense political landscape in France and abroad, the second edition of Paris+ by Art Basel returns to the Grand Palais Éphémère on Wednesday (18-22 October), with 154 leading galleries from more than 30 cities. The fair’s first edition, announced via a takeover of the regular slot of the Foire internationale d’art contemporain (Fiac), was organised in a condensed period of nine months. This time round, Paris+’s director, Clément Delépine, has had a full year to plan the sophomore show—although this run-time that “doesn’t feel like much longer”, he says.

Delépine’s team has focused on enhancing visitor experience, such as catering and fair furniture. The public programme has expanded too, especially the Parcours series of outdoor sculptures across the city, which this year has more artists and venues. But many of Art Basel’s further plans for its newest fair are being held until 2024, Delépine says. This is when Paris+ will shift to the stately Grand Palais, which is currently undergoing renovations, allowing it to increase its exhibitor capacity by around 25%.

But perhaps not much needs to be tweaked: the fair’s first edition appears to have been a success, with a handful of prominent galleries signing up for the first time this year, including Blum (formerly Blum & Poe), Kurimanzutto and PPOW. Virtually all major galleries which showed in the inaugural edition will return this week.

The wider French art market also remains in rude health. According to UBS’s 2022 Art Market Report, co-authored with Art Basel, France’s art market last year grew by $300m to a record $5bn, and maintained its position as the fourth-largest in the world. Signs of growth are evident across the city too. This past weekend, three major international galleries opened spaces in Paris: Hauser & Wirth, Mendes Wood DM, and Modern Art, and local spaces have also expanded, such as Poggi gallery.

Paris's art market came under threat earlier this year, when it was revealed that an EU directive would increase import VAT on all goods, including art, to 20%—removing the advantageous 5.5% rate currently paid in France. A margin scheme, which allows VAT to only be charged on profits, rather than total price, was also imperilled.

Last month, Le Monde reported that French ministers had successfully managed to exempt art from this directive. This was achieved by the lobbying of a coalition of galleries, auction house specialists and other art professionals across France, including Delépine. "A working group formed quite rapidly and was met with interest by the government. It's quite positive that we found a way to preserve the ecosystem," he says.

Urs Fischer's Wave (2023). Presented by Gagosian for Parcours, Paris + by Art Basel 2023

Courtesy of Paris+ par Art Basel

Delépine is careful to not exaggerate this wider market moment—he dismisses talk of a “Paris renaissance”—but he certainly acknowledges that "Paris has opened up in ways that it had not previously, and is more international than it used to be".

He describes the collecting of new private foundations and museums in France, such as the Bourse de Commerce and Luma Arles, as having "set the pace" for the growth of activity in Paris. Still, Delépine points out that the city has long been home to collectors and major institutions. Perhaps the biggest change is that "a new generation of collectors are more happy to open their doors, and invite people in—it's bearing fruit".

When Paris+ launched, its name made clear this was an event that would extend beyond just a trade fair, by activating venues and creative communities across the city. Delépine reaffirms this: "Paris is the backdrop, the perfect context for the intersection of art and other industries, such as fashion, design, architecture and gastronomy."

But media attention around the French capital in recent weeks has not been wholly pleasant: news of a bed bug infestation has hit headlines, although some reports say that the gravity of the situation is exaggerated. Delépine reassures that Art Basel is in contact with the relevant authorities and its partner hotels, to ensure that the regular protocols to prevent infestations are being put in place.

Still, this has not deterred galleries from pulling out the big guns. Pace will bring a $40m Rothko to its stand, themed around the American artist. This coincides with a major Rothko survey that just opened at the Fondation Louis Vuitton in Paris.

Speaking to the future of the Art Basel brand, Delépine says that he is interested in how recent ventures are increasingly considering "art in hybrid contexts", such as the Château La Coste in southern France, which combines a sculpture park, exhibition space, hotel, restaurant and vineyard.

Indeed, Art Basel's strategy to expand from a trade fair business and into a lifestyle brand fits into a general turn within the industry to merge art with other luxury goods and experiences. And there is surely no place better to do this than Paris, where the world's largest luxury goods conglomerates are headquartered.

But does this strategy risk overshadowing, and even watering down, the art on show? "We maintain the highest standards and a rigorous public programme," Delépine says. "Selection for the fair remains incredibly competitive and we continue to strive for curatorial excellence. That's the only way it will work."