You may have heard that we have entered a "crypto winter", meaning a period of decline mostly devoid of investment. The crypto market, as measured by market capitalisation, dropped by $1.46tn in 2022.

Still, NFTs and crypto art persisted at Art Basel Miami Beach in December last year. Tezos, the "sustainable" blockchain of choice, returned to the fair with a high-production booth hosting the fxHash generative art platform and panel discussions. The online publication on art and blockchain Right Click Save partnered with the tech platform Vertical Crypto Art on an offsite exhibition of generative art by women artists. It was the fourth Art Basel event that these four NFT power players had taken part in.

The continuity suggests that the art world's relationship with NFTs is not driven by the same motivations that have investors fleeing crypto like FTX founder Sam Bankman-Friedman to the Bahamas. There is no need to run or hide if you're proud of the product. So why are some artists, curators, museums, galleries, and collectors continuing to invest time and money into making, selling, and collecting NFTs?

Blockchain technology, which enables NFTs, is a data verification breakthrough that many of us still think can't help but change, well, everything—the art world included. For example, blockchain technology also underpins Decentralised Autonomous Organisations (DAOs) which are finding their way into the industry.

What are DAOs?

DAOs are online groups, usually organised on the social platform Discord, that use the same smart contract and blockchain technologies to enforce and enable something akin to shareholder meetings or democracy in action.

Though the idea of a community or organisation is an easy one to grasp, the most potentially innovative characteristics of DAOs are those of decentralisation and autonomy. Unlike real-life democracy where identity verification and voting administration cause friction, DAOs can verify who you are, if you have the right to vote, and purportedly execute voted-on instructions without points of failure. Because of the way information is logged and verified, the blockchain was conceived as a solution to online transactions without the interference of a third party such as a bank or a gallery.

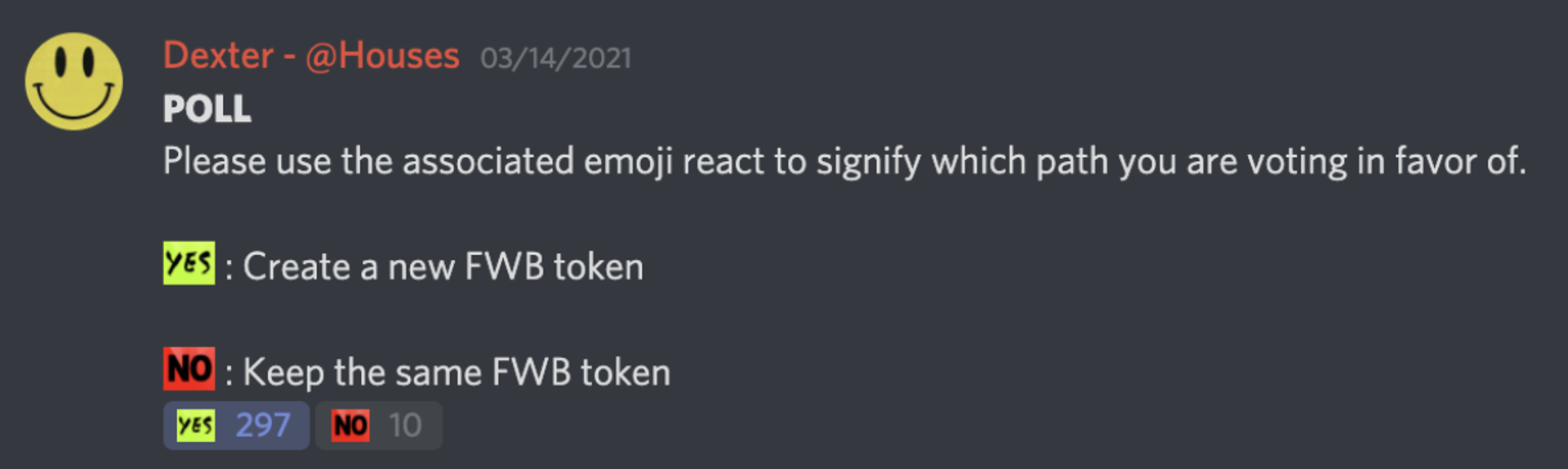

Screenshot of FWB members voting on Discord to create a new FWB token Courtesy of XXX

The idea of an egalitarian, self-governed community has often been dismissed as utopian. It is important to remember that the roots of crypto and NFTs lie in anarchy anchored in a distrust of centralised institutions such as banks, governments and the powers that be of the traditional art world.

DAOs make use of smart contracts to automatically process votes, execute transactions and record fractional ownership. Each DAO’s smart contract defines its specific parameters. Usually, members purchase governance tokens that grant them voting rights. Each vote is recorded on the blockchain and actions are executed if a majority votes in its favour. For example:

• If a majority of members vote to purchase “X NFT” under “Y$”, then the DAO will automatically proceed with the transaction using funds from its treasury. For example PleasrDAO famously purchased the "Doge" meme for $4m in June 2021. They subsequently fractionalised the NFT (broke it up into many individual tokens) to allow anybody to buy a portion.

• In the Friends With Benefits DAO, members regularly vote on creative projects to receive funding grants. They also have their own cryptocurrency ($FWB) whose value is tied to the DAO. Each member owns FWB tokens that essentially act as shares and incentivise them to act for the good of the organisation.

Anybody can write the smart contract for a DAO, but once it is deployed on the blockchain it functions as an autonomous entity and eliminates the need for any kind of hierarchical administration. All changes to the contract itself also need to be reviewed and voted on by members of the DAO. Decisions are made bottom-up, and executive power is completely automated on a model of 'perfect' direct democracy for those who hold voting rights, which are usually purchased.

The DAO-wnside

DAOs have their limitations. Voting is not anonymous. As with all transactions on the blockchain, they are recorded publicly and forever. This leaves space for manipulation in the form of peer pressure. In many DAOs, users can purchase several governance tokens, a practice which favours the richest members.

Most pressing are issues of scalability. Since contracts need a majority of members to vote in a certain direction to execute its functions, this means that a large majority of members must always remain active in the DAO’s decision-making processes. DAOs with too many members risk functioning very slowly.

Despite these issues, DAOs have emerged as powerful collecting forces. With their common treasury and focused objectives, they are interesting actors to reshape the current art market.

$4.5M raised to spend on womxn+ art: @siamusic, @grimes, @beeple, @guyoseary, @worldofwomennft @garyvee & many others support women-identified, non-binary LGBTQ+ artists as @unicorndao_xxx 🦄

— UnicornDAO🦄 (@unicorndao_xxx) May 19, 2022

thus far we’ve purchased $1.4M in works from under-represented groups in digital art. pic.twitter.com/j0xNoBPBIv

In early December, the Burns Halperin report was a stinging reminder of the white male face of the American art world. Some DAOs are trying to be part of the solution. UnicornDAO, co-founded in March 2022 by the Russian protest and performance art group Pussy Riot, collects NFTs by crypto artists from underrepresented groups. Their self-defined objective is to “redistribute wealth and visibility in order to create equality for women-identified and LGBTQ+ people”.

And DAOs are not limited to collecting crypto assets. In 2021, ConstitutionDAO made headlines for nearly purchasing a first-edition copy of the US constitution at a Sotheby’s auction. In 2022, Arkive DAO became the first blockchain-operated decentralised museum. Members vote on acquisitions and where to display their items. Their shared goal is not to show the collection in the most prominent institutions, but to display artworks in the context that fits them best. Arkive DAO were recently spotted at Art Basel Miami Beach with a beautiful booth in the UBS Collector’s Lounge—flying a flag for the technology, and proving that what happens on the crypto-optimistic beaches of Miami doesn't necessarily stay there.