Sotheby’s released its fourth-quarter results today with cautious optimism, reporting a net income for 2018 of $108.6m, down from last year’s $118.8m though still well above the $74.1m total in 2016. Total sales climbed 16%, reaching $6.4bn in total and spurred in part by a 37% jump in private sales, which accounted for $1.02bn and represents a five-year high, nearly doubling the level achieved in 2016. Aggregate auction sales increased 15% to $5.3bn.

For the fourth quarter, the auction house reported net income of $85.7m, a 12% increase over the same period in 2017. Per-share earnings were also up from $1.43 to $1.72, and the market liked what it heard during today's earning call—Sotheby's stock price rose more than 8% percent as the Dow Jones opened.

Yet the publicly traded company’s annual per-share value dropped from 2017’s $2.20 to $2.09 in 2018. Strictly by the bottom-line numbers, its total earnings leave Sotheby's just behind the privately owned Christie's, which last month reported $7bn in global sales, though that figure only represented a 3% increase on the previous year versus the former’s 16%. Being privately owned, Christie's also does not have to announce profit figures.

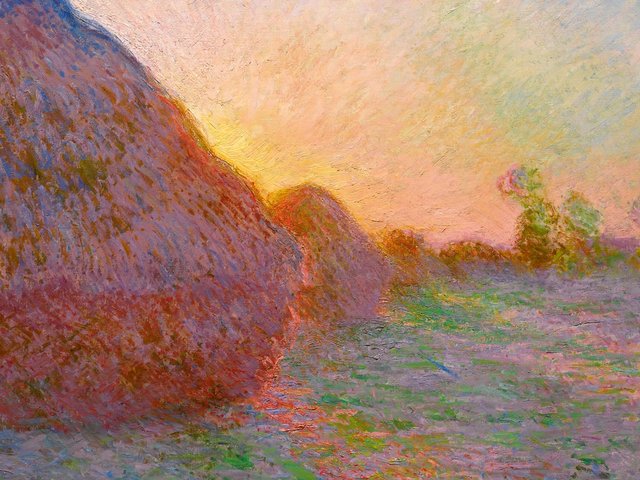

During the investors’s call, Sotheby’s president and chief executive Tad Smith cited highlights for the year including a 30% increase in Old Master paintings and drawings sales, pointing to the rare Rembrandt oil sketch that sold for £9.5m ($12.1m) in October to the Louvre Abu Dhabi. He also noted sales of approximately $1bn in Asia, the highest total in the auction house’s 45-year history in the region. Several important auction records for contemporary artists were also set in 2018, such as Kerry James Marshall’s Past Times, sold for $21.1m in New York in May, and the £9.5m ($12.4m) sale of Jenny Saville’s Propped in October’s London sales.

Among the highlights, Smith also included the May sale of Amedeo Modigliani’s Nu couché (sur le côté gauche) for $157.2m, which fetched the highest auction sale price in Sotheby’s history. The painting, however, was one of two “extra expensive” guaranteed works that “suppressed” the house’s commission margin in the first half of the year, reducing it from 1.4% to 1.1% in June. While the Modigliani work just managed to net above its low estimate, selling to the third-party irrevocable bidder, the other—Picasso’s Buste de Femme de Profil (Femme écrivant)—was offered with an in-house guarantee in London in June where it fell short of an unpublished pre-sale estimate of $45m and sold on a single bid of £27.3m ($36m).

Although its Auction Commission Margin (ACM) rebounded to 17.1% in the fourth quarter, Sotheby’s ACM for the entire year only reached 16.1%, versus 17.2% in 2018. “If you exclude the effect of these two paintings and look at what happened with the remainder of our business, our ACM would have been 16.7%,” the auction house’s chief financial officer Mike Goss said. Looking ahead to 2019, Goss sees the market dominated by estate sales that often carry lower margins and that they anticipate fewer exceptionally high-value paintings that affected earnings in 2018.

“On balance, the guidance we made at the end of Q2 that ‘16% is the new 17%’ is still relevant, but we also see a pathway to slight improvement in 2019,” Goss said, saying Sotheby's recently increased buyer’s premium would “help toward that end”.

What may also prove helpful on this front in 2019 is the replacement of Adam Chinn as chief operating officer. With a reputation as one of the auction house’s top deal makers, Chinn was a driving force behind developing the use of guarantees at Sotheby’s since he joined the firm in January 2016 after its widely-documented acquisition of Art Agency, Partners (AAP), in which he had been a partner. As of 1 January 2019, Chinn has been replaced by two people reporting directly to Smith: John Cahill in the role of executive vice president, chief commercial officer, and Ken Citron, as executive vice president, operations and chief transformation officer.

When investors queried Smith as to how the use of guarantees and the revised buyers’ premiums schedule might impact upcoming sales, he said that Sotheby's would only use guarantees in a way that “we think makes sense for the marketplace” which, as of right now, is “not at a particularly high level”.

The online consignment margin going forward, however, is “positively robust”, according to Smith. He attributed this to the new e-commerce platform the auction house debuted in 2018 that helped drive $72.1m in online-only sales, which is quadruple the previous year’s total; 37% of all lots sold in 2018 were purchased online. “We saw a record number of new bidders in 2018 and 64% of those bid online,” Smith says. In total, online sales, including items from live auction purchased online, reached $220.4m, up 24% from the prior year.

Of the capital poured into technology to enable more online business and further automation of sales, which will continue through 2019, Smith said the investment programme has somewhat “dampened” earnings margins while also pushing up spending beyond the company’s historical norms. In keeping with his anticipation of a “more subdued” art market in 2019 during Sotheby’s third quarter earnings call in November, Smith said: “Beginning in 2020, we believe that the results of our investments will be much more visible… and [our] margins will begin to climb and our capital spending return to a more typical level.”